These activities caused main shifts in the open market, swinging the underlying securities price severely. Moreover, the growing dark pool meaning use of HFT technology made it troublesome to execute orders well timed because of the dearth of the changing liquidity ranges these activities brought on. However, different parts play a major role within the stability of the system.

Would You Like To Work With A Monetary Skilled Remotely Or In-person?

Regulation ATS created a framework to raised integrate dark pools into the existing market system and to alleviate regulatory concerns surrounding them. The first darkish pool was created in 1986, with the launch of Instinet’s buying and selling platform referred to as After Hours Cross. It allowed investors to position nameless orders that had been matched after the markets closed. Just one year later, in 1987, a second platform emerged in the type of ITG’s POSIT. At this level, it may not be wholly clear the place the advantages lie with using darkish pools. Well, there are a couple of attention-grabbing advantages to utilizing darkish pools that we wish to contact on briefly.

Darkish Pool Liquidity Seeking Methods

The Bullish Bears commerce alerts include both day trade and swing commerce alert indicators. These are stocks that we publish daily in our Discord for our community members. The methods additionally include logic in plain English (plain English is for Python traders).

Are Trades At Midnight Pool Reported?

These strategies sometimes involve shopping for securities in the dead of night pool at a cheaper price than the public market after which selling them on the basic public market at a higher value, cashing in on the difference. Dark pools also can reduce worth discovery, that means that the true market value of a security is probably not accurately mirrored in the dark pool. Lit dark swimming pools are regulated by securities laws and are required to report their buying and selling exercise to the related authorities. This is particularly important for traders who handle massive portfolios and need to execute trades in a fashion that does not affect the price of the securities they’re shopping for or promoting. While these alternative buying and selling techniques are legal and regulated, they’re also fairly controversial. As a outcome, we will dig into every one and understand how darkish pool trading works.

Dark Swimming Pools: Navigating The Fourth Market: Exploring Dark Pools

As stock costs grew, it turned more durable for everyday retail merchants to purchase securities and trade. Then these HFT traders decided to conduct their businesses elsewhere, the place retail traders could be unaffected, and so they were much less likely to drive prices up. Only that the members are “big money” institutions, and the orders are saved private.

Dark swimming pools operate as private buying and selling venues the place institutional traders can execute massive orders anonymously. Orders are matched throughout the pool with out public market visibility, decreasing the impression on stock costs and providing confidentiality. If you’ve a connection to an institutional investor—such as proudly owning a pension fund or investing in mutual funds—dark swimming pools could make an influence on you personally. A dealer may be capable of assist these institutional traders obtain better pricing via a dark pool somewhat than paying the publicly listed worth on a lit change. This can imply higher returns for these institutional funds, which may trickle right down to the returns you see.

While they could profit the overall market, the benefits do not outweigh the potential issues. After the brief squeeze in 2021, the dark pool debate was ignited again as retail traders began wisening as much as shady techniques utilized by the massive players available in the market. Now that we have coated what darkish swimming pools are, how they work, and the risks and advantages, let’s look at some real-life examples of these entities and the way they impacted the market. The shorter time frames can be used to place long or short trades primarily based on what the darkish pool indicator and dark block trades are doing.

Other market participants will ultimately notice this huge motion and begin speculating on the inventory value, short-selling more shares, which might create a domino impact, sinking the stock price. The pricing on this approach does not include the NBBO quoting mannequin, so a price discovery is included within the impartial electronic darkish swimming pools. Therefore, dark pool merchants take pleasure in excessive liquidity in these types of dark pools after they commerce tens or tons of of thousands of assets and dollars. However, dark pool exchanges are completely authorized and are regulated by the US Security and Exchange Commission (SEC), which administrates the market and ensures that participants act in good faith.

As a end result, it’s an advantage to the large players however unfair to other buyers and traders. The special advantage offered places all different market individuals in a weak position. Since the inception of algorithmic buying and selling and trendy expertise, these packages have allowed traders to execute thousands of trades in seconds, providing an edge over others. When darkish pools are mixed with HFT, the trades executed with large volumes of hundreds of thousands of shares are also accomplished in seconds, giving the merchants an enormous benefit.

Another advantage of darkish pool trading for its customers is that buyers are often able to match sellers, despite the humongous sizes of blocks being traded. In addition to those general regulatory necessities, darkish swimming pools are topic to specific rules designed to promote equity and transparency within the trading process. For example, darkish pools should disclose the percentage of their trades executed on the midpoint of the nationwide finest bid and supply, which is a measure of the liquidity and competitiveness of the market. Dark swimming pools exist to supply institutional investors a way to execute large orders with decreased market impression and increased confidentiality. They assist prevent front-running and permit for extra discreet buying and selling compared to public exchanges. These off-exchange buying and selling venues are designed to supply anonymity and scale back market impact, especially for orders that could significantly affect stock costs if executed on public exchanges.

- This technique can be particularly effective at midnight pool as a end result of it allows traders to take advantage of market tendencies with out having to worry about market impact.

- Think of it as a secret membership for institutional buyers, like hedge funds and pension funds, to make big trades without tipping off the market.

- Some examples of exchange-owned dark pools are ASX Centre Point, BATS Trading, International Securities Exchange, and NYSE Euronext.

- This can be a helpful indicator of the extent of exercise inside a darkish pool and can help you gauge the level of liquidity in the market.

- They are doubtless permitted to operate as a end result of additionally they supply a quantity of advantages to the market.

With choices two and three, the danger of a decline in the interval whereas the investor was ready to sell the remaining shares was additionally important. There are many different strategies that can be used in dark pool buying and selling. The finest technique will rely upon the trader’s targets and danger tolerance. Some traders could favor to make use of liquidity provision strategies, whereas others might choose to make use of statistical arbitrage or momentum buying and selling.

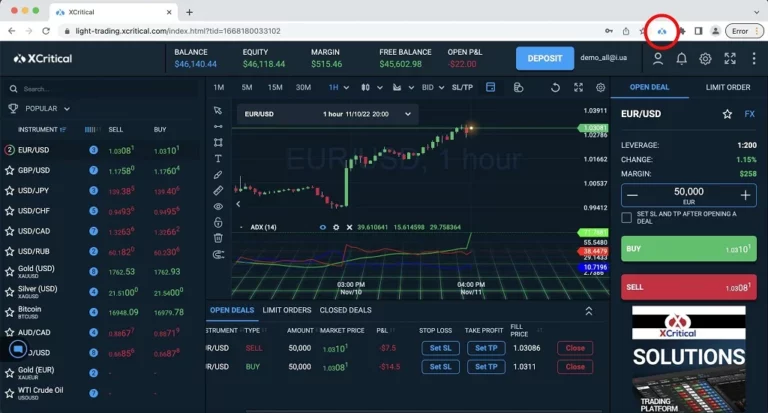

Read more about https://www.xcritical.in/ here.