The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company’s operations, financial position, and cash flows. Accounting records are the original source documents, journal entries, and ledgers that describe the accounting transactions of a business. Accounting records support the production of financial statements. They are to be retained for a number of years, so that outside entities can inspect them and verify that the financial statements derived from them are correct.

Compound Journal Entries

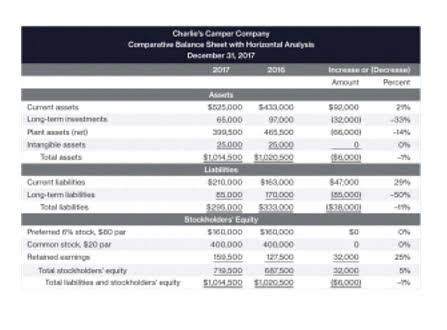

For example, the current ratio compares the amount of current assets with current liabilities to determine how likely a company is going to be able to meet short-term debt obligations. This is posted to the Cash T-account on the credit side beneath the January 14 transaction. Accounts Payable has a debit of $3,500 (payment in full for the Jan. 5 purchase). You notice there is already a credit in Accounts Payable, and the new record is placed directly across from the January 5 record.

Journalizing Transactions

The general ledger serves as the eyes and ears of bookkeepers and accountants and shows all financial transactions within a business. Essentially, it is a huge compilation of all transactions recorded on a specific document or in accounting software. As you record business transactions, sort them into categories.

See how employees at top companies are mastering in-demand skills

Another example is requiring approvals for large or unusual expenses. Implementing these controls adds an extra layer of security recording of transactions in accounting to your accounting cycle. It can also help you identify errors sooner because more people are reviewing the information.

Adjust Journal Entries

The following comments note the most common methods available. These recordation methods all create entries in the general ledger, or else in a subsidiary ledger that then rolls into the general ledger. From there, the transactions are aggregated into the financial statements. If you pay the bill immediately or pay cash for an item, all you need to do is record the expense and the reduction in cash in the appropriate accounts, as we did with the utility expense. If you’re not using accounting software, you’ll need to record this entry in the purchases journal.

- Returning to Supreme Cleaners, Mark identified the accounts needed to represent the $200 sale and recorded them in his journal.

- Expenses might be categorized as cost of goods sold (COGS), utilities, advertising, consulting and so on.

- There are debit and credit columns, storing the financial figures for each transaction, and a balance column that keeps a running total of the balance in the account after every transaction.

- Asummary showing the T-accounts for Printing Plus is presented inFigure 3.10.

- A summary showing the T-accounts for Printing Plus is presented in Figure 3.10.

- In this module we will introduce and learn to differentiate between cash accounting and accrual accounting.

Accounts Receivable has a credit of $5,500 (from theJan. 10 transaction). The record is placed on the credit side ofthe Accounts Receivable T-account across from the January 10record. In the last column of the Cash ledger account is the runningbalance.

- We know from theaccounting equation that assets increase on the debit side anddecrease on the credit side.

- You may also have additional entries, such as bank fees and interest earned, that will need to be posted before running financial statements.

- The following are selected journal entries from Printing Plusthat affect the Cash account.

- For example, if a company purchases office supplies and pays for them with cash, a debit card, or a check, then that is a cash transaction.

- Accounts Receivable has a credit of $5,500 (from the Jan. 10 transaction).

- Financial accounting plays a critical part in keeping companies responsible for their performance and transparent regarding their operations.

There are debitand credit columns, storing the financial figures for eachtransaction, and a balance column that keeps a running total of thebalance in the account after every transaction. Recall that the general ledger is a record of each account andits balance. Reviewing journal entries individually can be tediousand time consuming. The general ledger is helpful in that a companycan easily extract account and balance information. Accountants use special forms called journals to keep track of their businesstransactions. A journal is the first place information is enteredinto the accounting system.

Business transactions have an impact on your financial statements, and so they are recorded chronologically as journal entries. The purpose of using the double-entry accounting method is to make sure you’re balancing the fundamental accounting equation. If the sum of your debits is ever not equal to the sum of your credits, the equation is not balanced. You’d want to record that payment as a journal entry to log the transaction. Each journal entry typically records the date, the account you’re debiting or crediting and a brief description of the transaction that occurred. Financial accounting is dictated by five general, overarching principles that guide companies in how to prepare their financial statements.

How do we know on which side, debit or credit, to input each of these balances? The following are selected journal entries from Printing Plus that affect the Cash account. We will use the Cash ledger account to calculate account balances. Another example is a liability account, such as Accounts Payable, which increases on the credit side and decreases on the debit side. If there were a $4,000 credit and a $2,500 debit, the difference between the two is $1,500. The credit is the larger of the two sides ($4,000 on the credit side as opposed to $2,500 on the debit side), so the Accounts Payable account has a credit balance of $1,500.