At the time dividends are declared, the board establishes a date of record and a date of payment. The date of record establishes who is entitled to receive a dividend; stockholders who own stock on the date of record are entitled to receive a dividend even if they sell it prior to the date of payment. Investors who purchase shares after the date of record but before the payment date are not entitled to receive dividends since they did not own the stock on the date of record. The date of payment is the date that payment is issued to the investor for the amount of the dividend declared. The board of directors of a corporation possesses sole power to declare dividends. The legality of a dividend generally depends on the amount of retained earnings available for dividends—not on the net income of any one period.

Small Stock Dividends

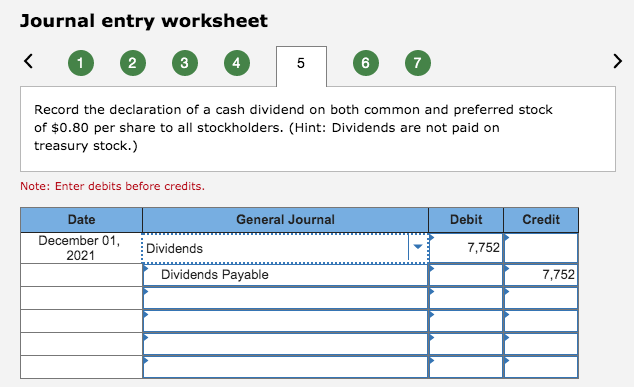

Credit The credit entry to dividends payable represents a balance sheet liability. At the date of declaration, the business now has a liability to the shareholders to pay them the dividend at a later date. Occasionally, a firm will issue a dividend in which the payment is in an asset other than cash. Non-cash dividends, which are called property dividends, are more likely to occur in private corporations than in publicly held ones. At the date of declaration, the business now has a liability to the shareholders to be settled at a later date.

Stock Dividend

Corporations experiencing growth generally are more likely to issue a stock dividend than stable, mature firms. It is a temporary account that will be closed to the retained earnings at the end of the year. However, recording dividends should be simple (especially if you have your bookkeeper do it).

Journal Entries for Dividends (Declaration and Payment)

Many corporations issue stock dividends instead of, or in addition to, cash dividends. A Stock dividend is a distribution to current shareholders on a proportional basis of the corporation’s own stock. And as with debiting the retained earnings account, you’ll credit the total declared dividend value. Suppose a business had dividends declared of 0.80 per share on 100,000 shares. The total dividends payable liability is now 80,000, and the journal to record the declaration of dividend and the dividends payable would be as follows. When a company declares a stock dividend, the par value of the shares increases by the amount of the dividend.

- The corresponding credit to dividends payable signifies the company’s obligation to pay the declared dividends to its shareholders.

- A long term investor might be prepared to accept a lower dividend payout ratio in return for higher re-investment of profits and higher capital growth.

- The declaration and distribution of dividends have a consequential effect on a company’s financial statements.

- This often occurs when the company has insufficient cash but wants to keep its investors happy.

- The total value of the candy does not increase just because there are more pieces.

This records the reduction of the dividends payable account, and the matching reduction in the cash account. Cash dividend is a distribution of earnings by cash to the shareholders of the company. One is on the declaration 4 ways to protect your inheritance from taxes date of the dividend and another is on the payment date. To record the declaration, you’ll debit the retained earnings account — the company’s undistributed accumulated profits for the year or period of several years.

Everything You Need To Master Financial Modeling

This transaction is straightforward and directly impacts the company’s liquidity, necessitating careful cash flow management to ensure that operational capabilities are not compromised. To illustrate how these three dates relate to an actual situation, assume the board of directors of the Allen Corporation declared a cash dividend on May 5, (date of declaration). The cash dividend declared is $1.25 per share to stockholders of record on July 1, (date of record), payable on July 10, (date of payment). Because financial transactions occur on both the date of declaration (a liability is incurred) and on the date of payment (cash is paid), journal entries record the transactions on both of these dates. The Dividends Payable account appears as a current liability on the balance sheet. To illustrate how these three dates relate to an actual situation, assume the board of directors of the Allen Corporation declared a cash dividend on May 5, (date of declaration).

This typically happens each quarter for U.S.-based firms, when the company declares a dividend amount at its own discretion. Accountants must make a series of two journal entries to record the payout of these dividends each quarter. When the company makes the dividend payment to the shareholders, it can make the journal entry by debiting the dividends payable account and crediting the cash account.

Retained earnings are the increase in the firm’s net assets due to profitable operations and represent the owners’ claim against net assets, not just cash. Many corporations, therefore, attempt to establish a quarterly dividend pattern that is maintained or slowly increased over a number of years. In profitable years, the corporation may issue a special year-end dividend in addition to regular dividends. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

In addition, corporations use dividends as a marketing tool to remind investors that their stock is a profit generator. Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared. When noncumulative preferred stock is outstanding, a dividend omitted or not paid in any one year need not be paid in any future year. Because omitted dividends are lost forever, noncumulative preferred stocks are not attractive to investors and are rarely issued. Cumulative preferred stock is preferred stock for which the right to receive a basic dividend accumulates if the dividend is not paid.